It has applied to list its shares on the New York Stock Exchange under the symbol “LNKD.” (Additional reporting by Yinka Adegode and Alina Selyukh in New York. If you’re in the market for a low-cost product yet notice that your go-to supplier’s option is expensive, you can show them the findings of your cost comparison. Morgan Stanley, Bank of America and JPMorgan are among the bookrunners for the LinkedIn offering.

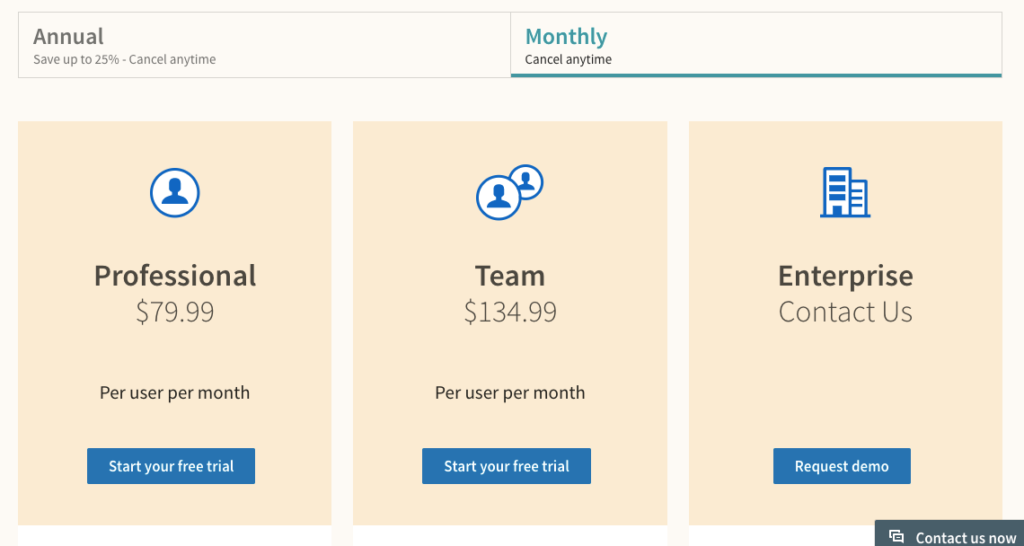

LINKEDIN PRICING OPTIONS COST COMPARIZON SOFTWARE

It plans to use the proceeds toward product expansion, hiring and acquisitions. See pricing for HubSpots all-in-one marketing software to help you grow traffic, convert visitors, and run complete inbound marketing campaigns at scale.

The company expects to receive net proceeds of about $146.6 million from the IPO, based on an assumed offer price of $33.50 a share. Additional channels for 6/mo per channel.

Investors Sequoia Capital, Greylock Partners and Bessemer Venture Partners, which together own about two-fifths of the company, will not participate in the IPO. Example: 2 Twitter profiles, 2 Facebook pages, and 2 Start Pages counts as 6 channels. Premium Sales - For sales professionals looking to generate leads and build pipeline - 79.99/mo. Other big stakeholders offering shares include Goldman Sachs GS.N, McGraw-Hill Companies Inc MHP.N and Bain Capital Venture Integral Investors LLC. Premium Business - For power-users looking for more access and insights - 59.99/mo.

Shares owned by co-founder and LinkedIn board Chairman Hoffman, who is among those stockholders selling shares in the IPO, would represent about 21.7 percent of voting power after the offering. LinkedIn is offering 4.8 million shares, and the rest will be sold by some of its stockholders.

0 kommentar(er)

0 kommentar(er)